UDGAM – Thousands of crores of rupees are deposited in banks without any claimants, prompting the launch of UDGAM by the RBI. However, for the identification of unclaimed deposits by the public, the banking sector’s regulator, the Reserve Bank of India (RBI), has launched a centralized web portal named UDGAM (Unclaimed Deposits – Gateway to Access Information). Through this portal, any individual can identify unclaimed deposits in banks.

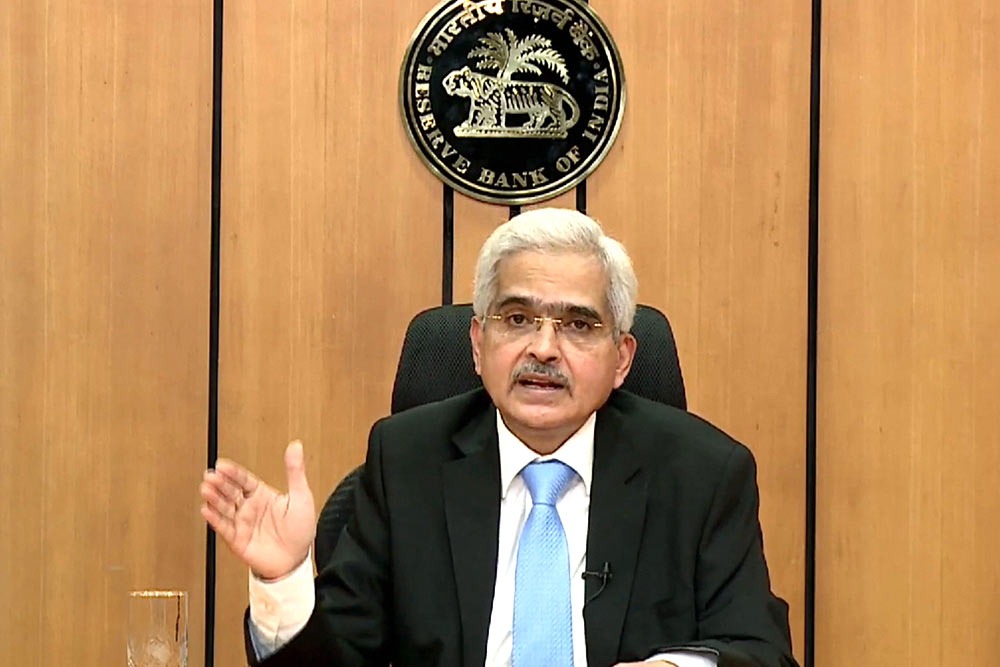

As per a press release by RBI, Governor Shaktikanta Das unveiled this web portal, which has been developed by RBI itself. This web portal will assist the public in identifying their or their family members’ unclaimed deposits in banks, even if they are deposited in more than one bank.

The construction of a consolidated online platform for tracking unclaimed deposits was announced by the RBI on April 6, 2023. In response to the growing trend of unclaimed deposits, RBI has also initiated an awareness campaign. RBI has advised the public to contact their respective banks to claim their unclaimed deposits.

Through the launching of the UDGAM (Unclaimed Deposits – Gateway to Access Information) web portal, users will be able to both identify and claim unclaimed deposit accounts or reactivate dormant deposit accounts in their respective banks. RBI has indicated that details of unclaimed deposits in seven banks are currently available on the website for users to access. Details of unclaimed deposits in other banks will be uploaded to the portal in a phased manner by October 15, 2023.

Recently, the government informed the Parliament that public sector banks transferred an amount of ₹36,185 crores to the Depositor Education and Awareness Fund (DEAF) by March 31, 2023. In contrast, this amount was only ₹15,090 crores in March 2019. Private banks, on the other hand, transferred ₹6,087 crores to this fund by March 31, 2023.