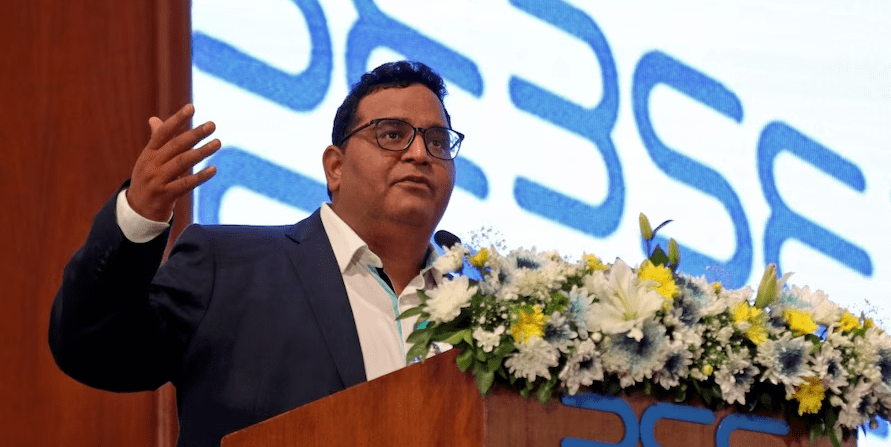

An agreement has been entered into by Vijay Shekhar Sharma, founder, MD & CEO of One 97 Communications, which operates the payments platform Paytm Ltd., to acquire 10.3 percent of the company’s shares from Antfin (Netherlands) Holdings B.V.

Based on Friday’s closing price, the stake purchase worth $628 million will be made. An entity named Resilient Asset Management B.V., in which Sharma owns the complete 100 percent stake, will receive the transfer of 6.53 crore shares of Paytm from Antfin. As a result of this transaction, Paytm’s largest shareholder will be Vijay Shekhar Sharma, and Antfin will be displaced.

Resilient Asset Management B.V. will issue Optionally Convertible Debentures (OCDs) to Antfin as consideration for the transfer, and to retain economic value, as stated by Paytm. Optionally Convertible Debentures are debt securities that enable an issuer to raise capital, and in return, the issuer pays interest to the investor until maturity.

The largest shareholder status of Antfin in Paytm will now be ceased, with its stake being reduced to 13.5 percent. Post the transaction, Vijay Shekhar Sharma’s stake in the company will be increased to 19.42 percent

Nearly a 50 percent gain has been observed in the shares of Paytm on a year-to-date basis. This gain comes after a correction of 13 percent from its 52-week high of Rs 914. The stock experienced a rebound after reaching an all-time low of Rs 438, which was approximately 80 percent below its IPO price of Rs 2,150.

The company had its best quarter in terms of share price returns since its listing during the April-June quarter.

The Paytm share price has risen by 9% following the announcement that Vijay Shekhar Sharma will be buying Antfin’s 10.3% stake in a non-cash deal